Earnings and Employment

Real earnings have fallen sharply while numbers in employment have grown

Earnings from employment form the largest component of household income and changes in earnings and employment have been the most important determinants of changing living standards since the 2008–09 recession.

The labour market has can be characterised by two main trends since the recession. The first is the remarkably robust levels of employment; with unemployment rising relatively little in the recession given the large fall in GDP, followed by surprisingly large increases in employment since then. On the other hand, earnings have risen less quickly than inflation and have consistently grown less fast than expected by independent forecasters such as the Office for Budget Responsibility.

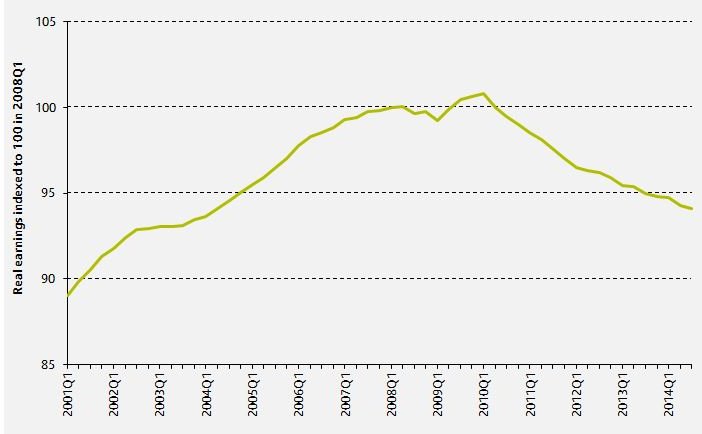

As shown in Figure 1, average weekly earnings have fallen by 5.9% (after adjusting for CPI inflation) since 2008Q1. By 2014Q3, average weekly earnings were £478 per week, around the same in real terms as they were over 10 years earlier in 2004Q2. The employment rate, which had fallen from 73.0% prior to the recession to a low of 70.1% in 2011Q3, has returned to 73.0%. The total number of people in work have risen from 29.7 million to 30.8 million since 2008Q1. Since the Coalition government was formed in mid-2010, mean real earnings have fallen by 5.7%, while the total number of people in employment has risen by 1.6 million.

Figure 1. Real average weekly earnings since 2001 [get the data for this graph]

Source: IFS calculations using ONS series KAB9. Earnings are adjusted for inflation using the RPIJ index and expressed in constant (2014Q3) prices. Earnings are reported using a 4-quarter moving average, with the last quarter labelled.

Different parts of the population have faced different changes in the labour market since the recession. On average young adults, particularly those in their 20s, have seen the largest falls in employment and earnings. The public and private sectors have also had diverging trends since the recession. As shown in Figure 2, while public sector employment rose gradually throughout 2008 and 2009, it has since fallen by 430,000. On the other hand, private sector employment fell by 800,000 peak to trough in the recession, but has since more than recovered, rising by almost 2.2 million since early 2010. The pay of private sector workers also fell by more than public sector workers up to 2011, since when pay restraint in the public sector has meant that private sector earnings growth has been faster than that in the public sector. The net result has been that the private / public pay relativity has almost returned to its pre-recession level.

Figure 2. Public and private sector employment since 2008-Q1 [get the data for this graph]

Source: IFS calculations using ONS Public Sector Employment Statistics.

Notes: Public and private sector employment adjusted for the nationalisation (and subsequent privatisations) of financial corporations, privatisation of Royal Mail and the reclassification of FE and Sixth Form colleges in England to the private sector.

Some groups have seen particularly large rises in employment, in particular women aged 55 to 69 and men aged 65 to 69. Some of this is due to public policy, such as the increase in the female state pension age. The employment rates of lone parents have also risen, partly in response to stronger job search requirements on out-of work benefits. There have also been particularly large increases in self employment since 2010.

IFS election 2015 publications

The 2015 IFS Green Budget

Jonathan Cribb and Robert Joyce, Earnings since the recession, The 2015 IFS Green Budget, Carl Emmerson, Paul Johnson and Robert Joyce (eds.), February 2015

Useful resources

This article examined the changes in employment and wages during the recession and compares the changes with previous UK recessions.

This chapter from the IFS Green Budget 2013 examines the reasons why employment growth has been so strong compared to GDP growth; a phenomenon known as “the productivity puzzle.”

Chapter 5 of this report analyses in depth the changes to the labour market outcomes of young adults aged 22-30 and how this has affected their living standards.

This report analyses the increasing employment rates for older people and provides some explanations for recent trends, while this paper shows the effect increasing the state pension age has had on employment of older women.

This briefing note documents changes in the public sector workforce and this report looks in detail at changes in public and private sector pay.