Business Taxes

Remarkable investment in cutting corporate tax rates has made UK regime more competitive

Corporate income tax

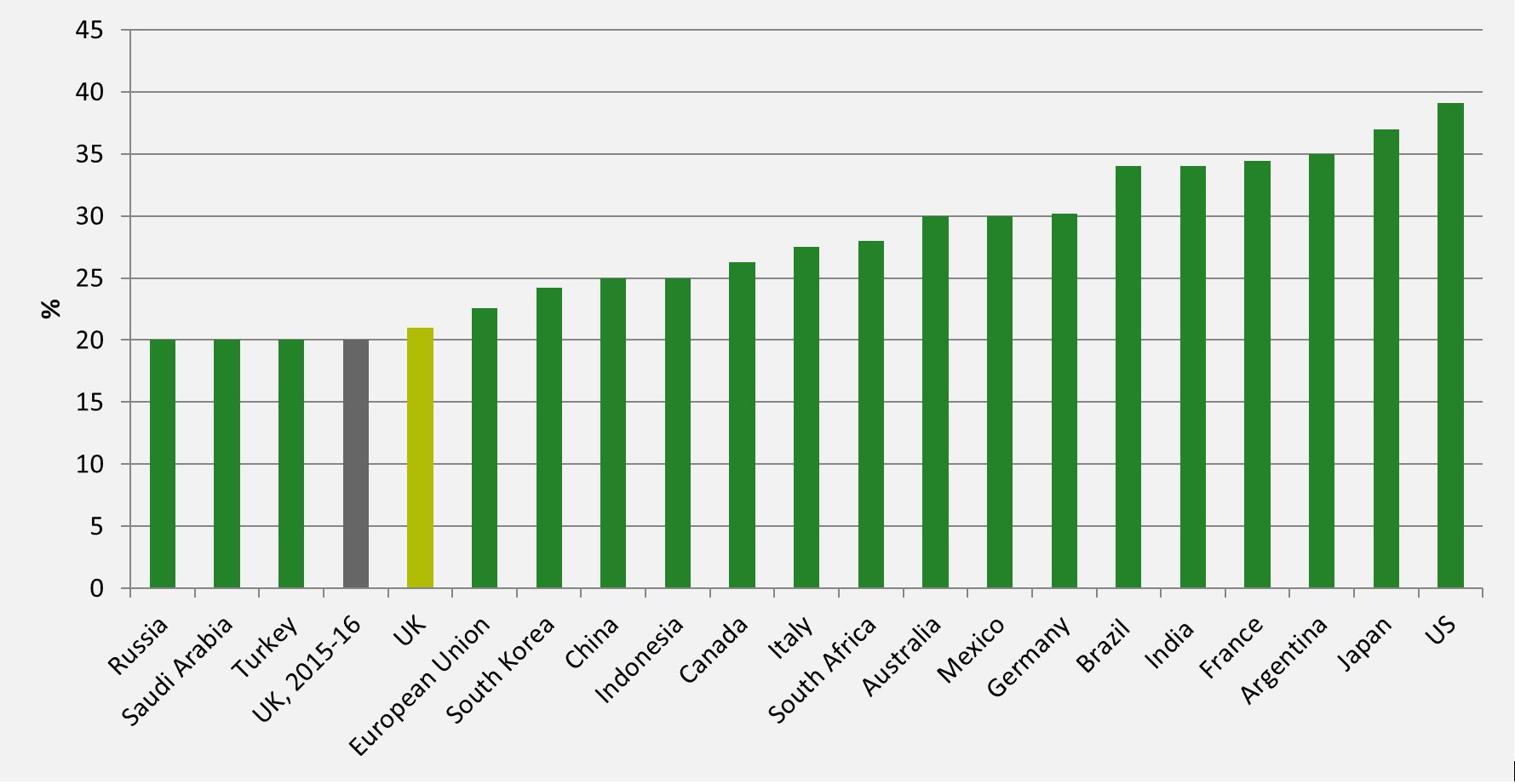

In 2010 the coalition published a ‘corporate tax road map’ setting out the aim to create ‘the most competitive corporate tax regime in the G20’. The key policy changes that followed have been a reduction in the main corporate tax rate from 28% to 21%, with a further cut to 20% planned for April 2015, the introduction of a Patent Box and reforms to the taxation of foreign income. The Patent Box was initially announced under the previous Labour government and the reforms to foreign income taxation followed from the move to an exemption of foreign source dividends in 2009. The Coalition government has also made changes to the tax base. Notably, capital allowances for plant and machinery were reduced in 2012 and, in a demonstration of how not to design the tax system, the Annual Investment Allowance has been decreased and then increased twice for a temporary period. The cost of cuts to the main rate is around £7.6bn a year. Other onshore corporation tax changes are roughly revenue neutral.

The ranking of the UK’s headline tax rate has improved since 2010 and the rate is now one of the lowest in the G20 (see Figure 1). However, this is matched with a broad tax base that is internationally uncompetitive. That is, the UK offers less generous capital allowances than almost all other OECD countries. As a result, the overall system is less competitive than the headline rate suggests, especially for companies that earn relatively low profits but undertake significant investments. The Patent Box makes the UK a more attractive destination for some types of investments, but the UK is now one of 12 European governments to offer such a policy and it is not clear what benefits will result. Recent work by IFS researchers discusses issues around Patent Boxes, which are currently being investigated by the by the EU’s Code of Conduct group.

Figure 1. G20 corporate income tax rates, 2014 [get the data for this graph]

Notes: Measure refers to the combined corporate income tax rate, which includes local taxes where relevant. The value for the European Union is an unweighted average across EU countries.

Sources: OECD Tax Database, Table II.1., PKF worldwide tax guide 2014 and KPMG tax profiles.

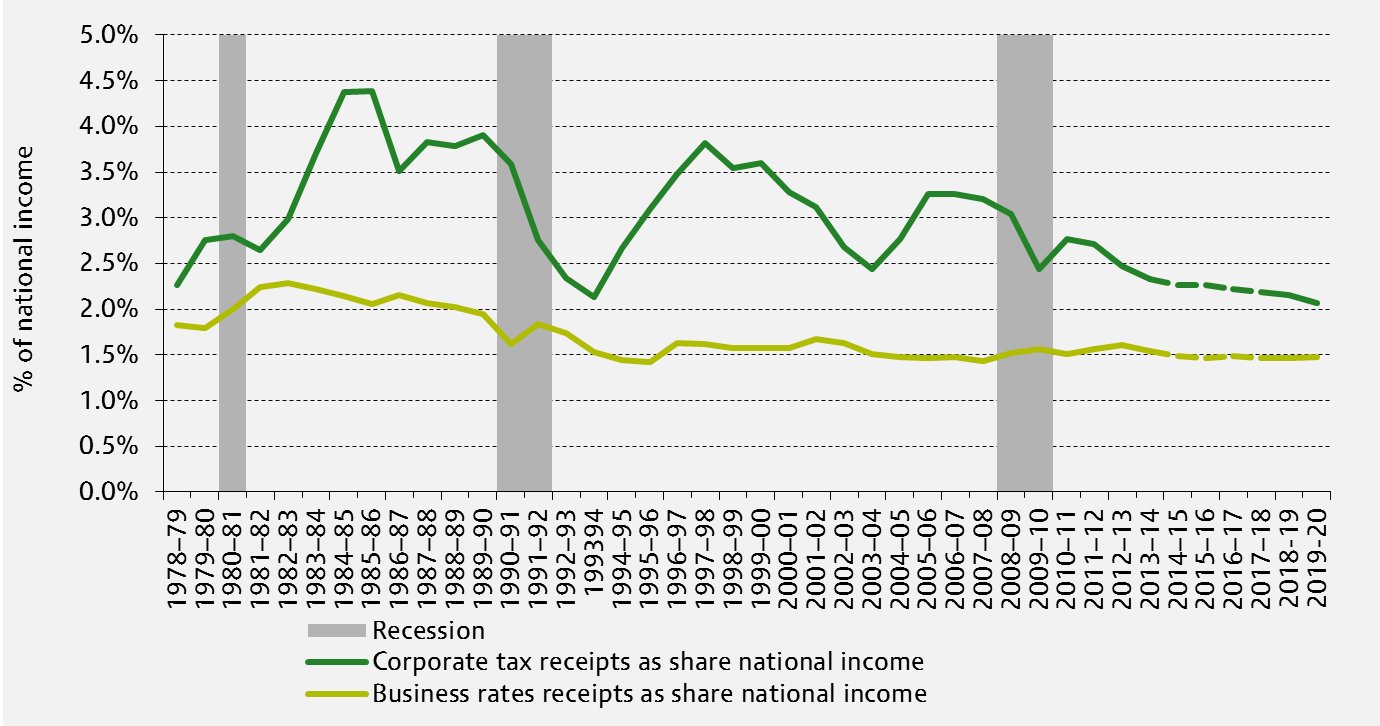

In 2013–14 corporation tax net receipts were £39.3 billion, which amounts to 6.6% of total receipts and 2.3% of national income (see Figure 2). Receipts, and especially those from the financial sector, have fallen sharply since the recession, having peaked at £48.0 billion in 2007-08. The latest OBR projections (March 2015) suggest that revenues will continue to fall as a proportion of GDP across the forecast period.

Figure 2. Receipts from corporation tax and business rates [get the data for this graph]

Sources: IFS fiscal facts data. Figures for 2013–14 onwards from Table 4.5 of Office for Budget Responsibility (December2014). Real Corporate Tax receipts deflated using a 2013–14 GDP deflator. National income (GDP) and GDP deflator from here.

Note: Corporate tax receipts includes onshore and offshore (including petroleum revenue tax) receipts. The trends look comparable if North Sea revenues are excluded.

Over a longer period though, and notwithstanding significant volatility, the share of corporate tax receipts in national income showed no obvious downward trend in the period from the 1980s to 2008. This was despite the fact that the main rate of corporation tax more than halved (from over 50% to 28%) over that period and in contrast to long running concerns that corporate tax revenues will decline as the income from corporate activities becomes more mobile.

In recent years there has been concern about tax avoidance by multinationals and the effects that this may be having on revenues. The 2013 Green Budget analysis contains a discussion of revenues and avoidance. The UK is currently engaged in the OECD Base Erosion and Profit Shifting (BEPS) project, which aims to promote international cooperation in reducing avoidance and is due to conclude by the end of 2015.

Bank levy

In the June 2010 Budget, the Chancellor announced the introduction of the bank levy– a tax on certain equity and liabilities of banks and building societies. One of the stated aims was to ‘ensure that the banking sector makes a fair contribution...reflecting the risks it poses to the financial system and the wider economy.’ The government has announced increases to the bank levy rate on eight occasions in the last four years. The March 2015 OBR forecast suggests that the levy will raise £2.8 billion in 2014-15 and £3.6 billion in 2015-16. The government had previously announced that it saw £2.9 billion each year as a reasonable revenue target. After the increase in the rate in Budget 2015 to 0.21%, the levy is expected to raise significantly more than that from 2015–16 onwards.

Business Rates

The other large tax collected from businesses is business rates, which is levied on the estimated market rental value of most non-residential properties. In 2013-14, business rates raised £26.8 billion, which represents 4.4% of total revenue. Across the forecast period, revenues are predicted to be relatively flat as a share of national income (see Figure 2).

Since 2010, the government has made a number of changes to business rates. These have included a delay to the revaluation of properties, temporary reliefs for low-value properties and retail properties and a move to allow local authorities in England to retain (for a limited period) between a quarter and a half of the rates revenue raised from new developments. Scotland has also introduced a localisation scheme for business rates. From April this year, business rates will be fully devolved to Wales. In 2014 the government undertook a review of the administration of business rates. In Autumn Statement 2014 the government announced a review of the structure of business rates, which is due to report by Budget 2016.

The recent policy moves, as well as possible alternative reforms, are discussed in this chapter of the 2014 Green Budget analysis.

IFS election 2015 publications

Briefing notes

Helen Miller and Thomas Pope, 'Corporation tax changes and challenges', Institute for Fiscal Studies: 26 February 2015, IFS briefing note BN163, election briefing note 2015 No. 5, ISBN: 978-1-909463-76-9

Observations

Helen Miller and Thomas Pope, £8 billion giveaway used to boost corporate tax competitiveness, Institute for Fiscal Studies: 26 February 2015, Observation

Useful resources

A presentation given at the IFS Budget briefing 2015 looked at the implications of Budget announcements for pensions, savings and business taxation.

For a discussion of trends in corporate tax revenues, issues around avoidance, and the taxation of North Sea oil and gas see Chapter 10 of the 2013 Green Budget.

Recent policy changes, including the possibility of devolving corporate tax to Northern Ireland are discussed in Chapter 10 of the 2012 Green Budget

An overview of recent developments in business taxation can be found in chapter VI of this paper.

Recent work on the effective tax rates provided by the UK Patent Box and similar regimes in other European countries can be found here. Discussion of the UK Patent Box policy and the potential rationale for having such a policy can also be found here and here.

A discussion of recent changes to Business Rates and options for reform can be found in chapter 11 of the 2014 Green Budget.